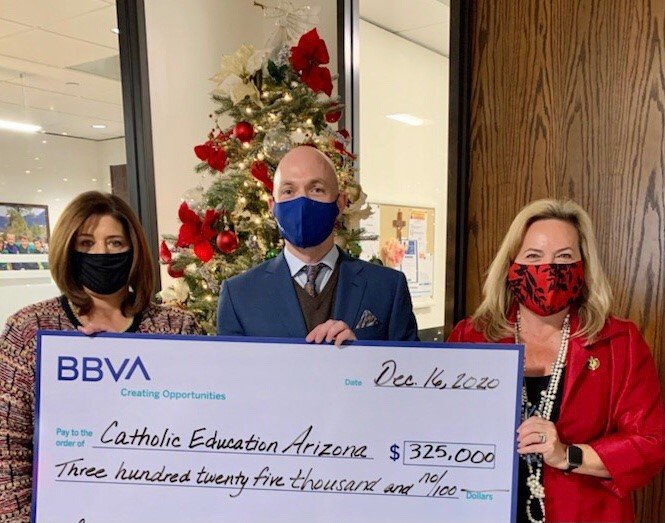

Featuring Brett Plains, Senior Vice President

The corporate tax credit is an easy way to invest in education, the community, and the future workforce. Why do you choose to participate in the Corporate Low Income Tax Credit program?

BBVA’s global mission is to bring the age of opportunity to everyone. The corporate tax credit is an opportunity for us as an organization to contribute to and invest in the communities we serve. They are just one facet of the bank’s overall efforts to bring that mission to life:

- Community development finance

- Employee volunteerism

- Community giving through our foundation

Corporate tax credits allow us to support organizations that share our mission, like Catholic Education Arizona, to provide equal opportunity for education.

Is there any advice you would give to businesses who are not directing their taxes to the Corporate Low Income Tax Credit Program? What is the benefit of participating?

Absolutely look into the Corporate Low Income Tax Credit Program! If you qualify and have an Arizona tax liability, it’s an amazing program that invests in our community’s future leaders. Through the program, individuals and corporations have the ability to change the lives of many students. This program creates opportunities for those that may be less fortunate and it gives them access to a quality education. The better question may be, why don’t all companies that qualify participate? The answer may be that they are unaware of the program, or they may not know who can help them navigate the process. Here at BBVA USA in AZ, we love the program!

Tell us about BBVA’s history and expertise.

BBVA USA has served Arizona Communities since 1998, previously under the name Compass Bank. We understand that every individual and company has unique dreams and ambitions, and we want to create opportunities for all of them. Our commitment shows itself in the places where we live and do business through our community reinvestment, charitable giving, employee volunteerism, sustainable practices, and diversity and inclusion. We provide commercial and retail banking services through our 63 offices across Arizona. We also provide financial education and tools for financial health through our employee volunteers.

In this unusual year, how has BBVA been impacted and what, if anything, has been done differently to respond to the needs of customers this year?

BBVA USA responded swiftly and efficiently to help protect the health and safety of our clients and employees, while continuing to aid our clients in the best ways possible. We were one of the first banks in AZ to get PPP dollars in our customers’ hands to help them keep employees on payroll. We were one of the first lenders to sign up to be a “Main Street Loan Program Lender,” and we granted deferrals to many of our customers in very short order. Our goal was to be part of the solution and really show our clients we care, and I think we were successful in doing so. We did everything in our power while complying with banking regulations, and we did it rapidly.

What differentiates BBVA from other similar financial institutions in Phoenix?

We think big, put our customers first, and we work as one team. We are a big bank, but we deliver our solutions in a way that feels like a community bank. We take the time to ask better questions to really get to know our customers and the issues they face. Our goal is to find better solutions for our customers. This is only possible by having the most talented bankers in Arizona. I’d put us up against any bank in the Valley!