Contribute

Option 2: Mail-in Your Contribution

Credit for Contributions to School Tuition Organizations

How Does it Work?

For 2025 (through 4/15/26): the limits are $1,535 for single / $3,062 for married filers.

To contribute:

- Call: 602-218-6542

- Online: Set up your very own, personalized contributor portal, or contribute as a guest

- Mail: Complete and mail in the contribution form you have or use the printable contribution form from this website

- If you contribute online through the CEA website, a tax receipt will be emailed to you immediately upon confirmation of your tax credit contribution or you are able to print your tax receipt upon successful completion of your contribution. It may be necessary to check your “spam” folder or call the CEA office if your receipt doesn’t arrive via email.

- If you make your tax credit contribution by phone, a tax receipt will be emailed or mailed to you, per your request, and if by mail, your receipt will be mailed.

Please present your tax credit receipt to your tax preparer as proof of tax payment to CEA.

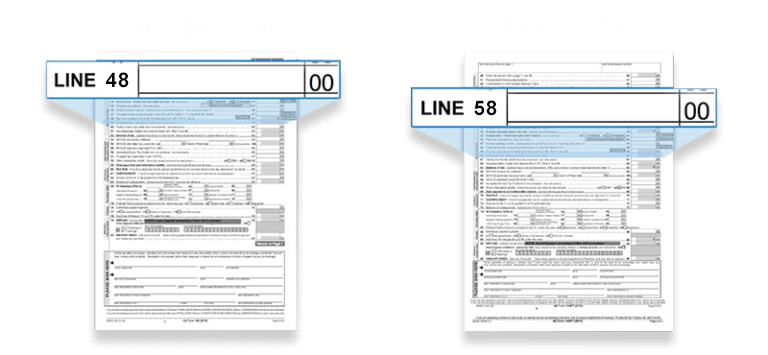

If you file taxes without assistance from a tax preparer, a reminder that Tax Forms 323 Original” and possibly Tax Form 348 “Overflow/Switcher” will need to be completed. Both forms are conveniently available on our website in English and Spanish.

Create a Tax Year 2025 Contribution Schedule through Scheduled Pay!

Scheduling your Arizona tax credit contribution to Catholic Education Arizona (CEA) over several months makes it easy to take your tax credit for our Catholic schools. If making smaller payments suits your budget, here’s how you can make monthly or bi-monthly contributions through Scheduled Pay!

- Please click the “Create a Tax Year 2025 Contribution Schedule through Scheduled Pay!” link to begin your scheduled contributions through December 31, 2025 for Tax Year 2025.

- You will be prompted to register in the CEA Contributor Portal.

- Choose the amount you would like to contribute each month and select the day of the month most convenient for you.

Need help? No problem. Please call Catholic Education Arizona at (602) 218-6542 to set up monthly contributions over the telephone.

Diocesan Employee Payroll Deduction Benefit

As an employee of the Diocese of Phoenix, you can support our Catholic schools “without any reduction in your net pay” through the Employee Payroll Deduction benefit. Offered by the Diocese, this benefit directs state taxes already being withdrawn from your paychecks to Catholic Education Arizona instead of to the state of Arizona.

1. Click the blue “Change Charity Contributions Box

2. Select Catholic Education Arizona Option 1* or Option 2**

3. Select Filing Status

4. Input amount to redirect each pay period

5. Complete brief questionnaire

6. Confirm selections and complete enrollment

This opportunity is designated a “Life Event,” meaning you can enroll at any time all year ‘round. You do not need to wait until “Open Enrollment” in May or November. You must re-enroll every year.