How to Donate from Your IRA: The Qualified Charitable Distribution

Are you looking to support scholarships for underserved students in a tax-savvy way? An IRA Qualified Charitable Distribution (IRA-QCD) is a powerful way for individuals 70½ years or older to give directly from their IRA to a qualified charity like Catholic Education Arizona.

What Is an IRA QCD?

- A QCD is a tax-free withdrawal from your IRA that is donated directly to a charity like Catholic Education Arizona.

- Transfer of up to $108,000 annually from your IRA to a qualified charity. For married couples, each spouse can make QCDs up to the $108,000 limit for a potential total of $216,000.

- Available to individuals 70½ or older.

- For those subject to Required Minimum Distributions (RMDs), a QCD can be used to satisfy all or part of your annual RMD.

How Does It Work?

Individuals save for retirement in pre-tax accounts like 401(k)s, 403(b)s, or IRAs. Upon retirement, these funds are typically rolled into an IRA. Once retirees reach 73, the IRS mandates Required Minimum Distributions (RMDs) from their IRA accounts, which are subject to taxation. However, an IRA-QCD allows donors age 70½ or older to bypass these taxes by transferring up to $108,000 annually (per individual) directly to a charity.

Important Note: Can I use this to pay my taxes?

IRA-QCDs are not eligible for a tax credit. Because the funds go straight from the IRA custodian to the charity, they do not count as taxable income for the donor. You cannot take credit for funds that were never included in your taxable income—this is a key distinction donors should understand when planning their giving strategy.

Even without a tax credit, the financial benefits are clear. Our donor, Mr. McLellan, shared why he gave.

“Anyone with a 401K who is at the age where they are required to make an annual distribution (RMD) should make all their charitable contributions from this fund. Here are the numbers. In this example an individual has decided to make $10,000 in total charitable contributions for the year. He/she is in the 30% tax bracket. The IRS allows you to make all your charitable contributions on a pre-tax basis. This means you would need $14,285 in after tax dollars ($14,285 x .70) to equal $10,000 in charitable contributions on a pre-tax basis. A no-brainer.”

Why Choose Catholic Education Arizona?

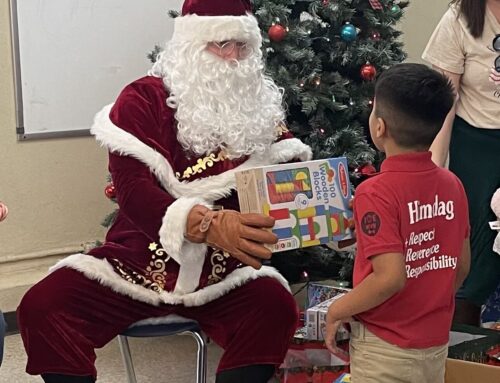

Donors who choose Catholic Education Arizona have the opportunity to transform these tax-advantaged funds into life-changing scholarships for underserved students, granting them access to a high-quality education and brighter futures.

How to Get Started

Getting started is simple:

- Contact your IRA custodian to initiate the transfer directly to Catholic Education Arizona.

- Specify the gift as an IRA-QCD.

- Receive an acknowledgment letter from Catholic Education Arizona confirming compliance with IRS guidelines.

To learn more about IRA-QCDs and how you can fund scholarships, visit https://myimpact.catholiceducationarizona.org/ or call our Development team at

(602) 218-6542.