At Catholic Education Arizona, we help businesses transform their tax liability into opportunities for impact through dollar-for-dollar corporate tax credits. By redirecting your Arizona state tax liability, your company can fund scholarships for underserved students in our Catholic schools across the Diocese of Phoenix, creating lasting educational investments. Ready to learn how corporate tax credits can benefit your business and Arizona’s youth?

Basics of Corporate Tax Credits

Catholic Education Arizona leverages corporate tax credits under Arizona law (ARS 43-1183 and ARS 43-1184) to support students facing financial barriers. Businesses that file as C-Corps, S-Corps, and insurance companies can redirect up to 100% of their state tax liability to fund tuition for low-income, disabled, or foster care students. This dollar-for-dollar credit reduces your tax bill directly, turning what you owe into scholarships that change lives.

Eligibility and Contribution Process

If you file as an S or C Corporation or an Insurance company that pays Az Premium Tax, determine you tax liability by consulting with your tax preparer or looking at last year’s Az return. Submit a commitment form to corporate@ceaz.org, and CEA will handle the rest! These credits are awarded first-come, first-served basis.

Real Impact Through Testimonials

Corporate tax credits through Catholic Education Arizona have profound effects, as shared by the Sullivan family, who educated all nine of their children in Catholic schools. They said, “Do not let the price tag scare you away!” The scholarships funded by business contributions enabled their children to access faith-based education, leading to strong academic performance and community contributions in fields like education and business.

Jamie Janos, an alumnus pursuing medical school, credits his success to the foundation built by his Catholic education: “I wouldn’t be where I am today without the foundation of my Catholic education.” His scholarship, supported by corporate tax credits, removed financial hurdles, allowing him to excel and prepare for a career in healthcare. These stories from our testimonials page illustrate how your business’s corporate tax credits can propel students toward lifelong success.

Benefits for Businesses and Communities

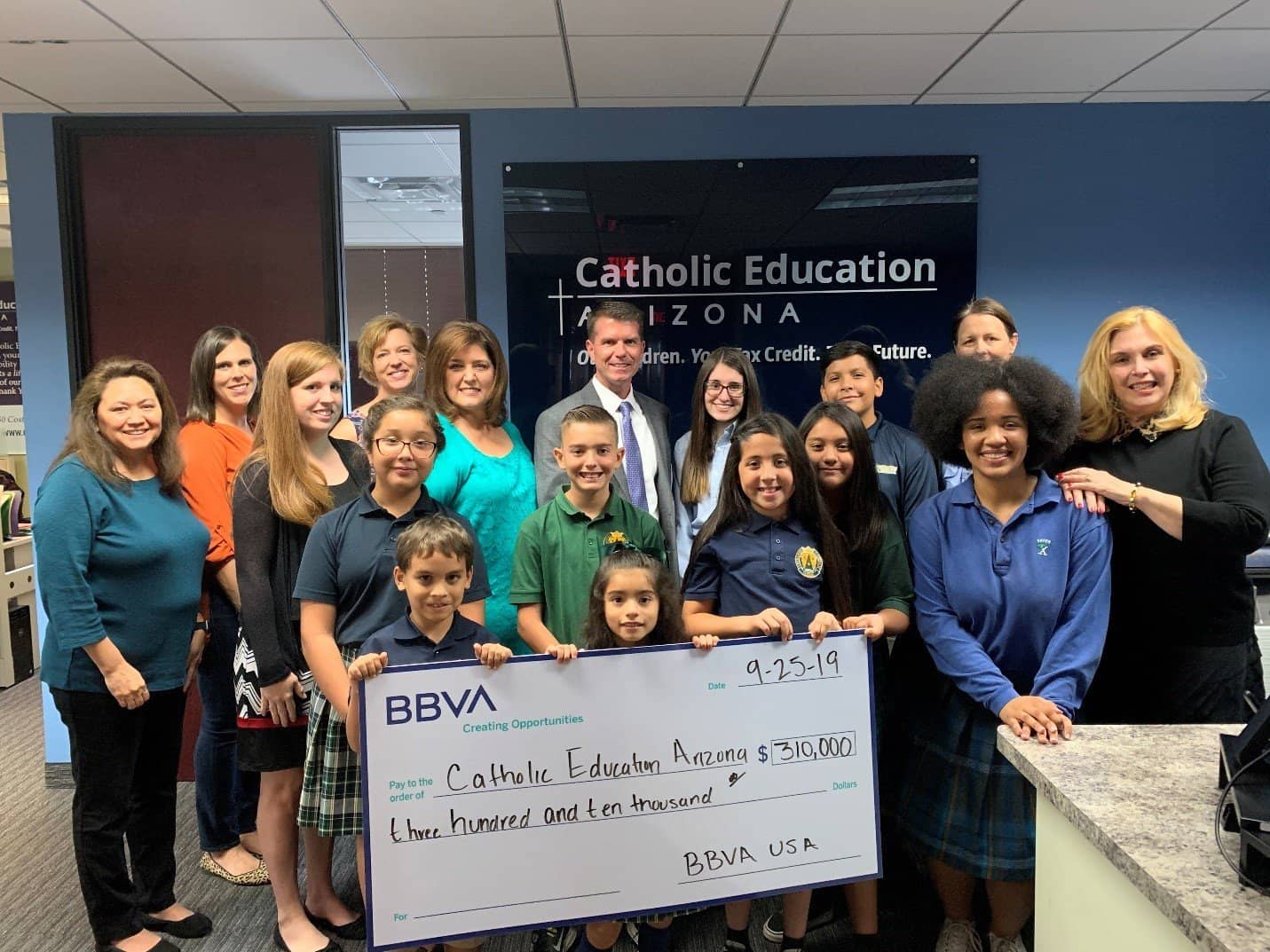

Redirecting corporate tax credits offers businesses more than tax savings—it builds goodwill and community ties. By partnering with Catholic Education Arizona, your company joins leaders from all sized businesses, demonstrating commitment to local education.

On a broader scale, corporate tax credits align with efforts to promote educational equity. The Cruz-Patino family, with three daughters in Phoenix Catholic schools, expressed, “We are a dual-working family. However, our finances do not allow us to save enough money to pay for the full tuition costs. We thank you.” Your support through corporate tax credits helps families like theirs access opportunities that strengthen Arizona’s workforce and communities.

National Value of Catholic School Investments

Investing corporate tax credits in Catholic Education Arizona yields national benefits. The National Catholic Educational Association notes that Catholic schools save billions annually by providing high-quality education with limited public funds, lowering costs in social services and justice systems. Graduates like Jamie Janos contribute as professionals in medicine and other essential fields, creating a positive societal return.

Since 1998, Catholic Education Arizona has raised $383 million and awarded 161,000 scholarships, fostering a pipeline of ethical leaders. By directing your corporate tax credits here, your business supports a system that produces capable graduates, benefiting Arizona’s economy and the nation at large while turning tax liability into enduring educational value.

Maximizing Your Investment

Consider combining corporate tax credits with other initiatives, like our Changing Lives with Legacy division for non-tax credit donations and planned gifts, to amplify impact. With annual audits and IRS Form 990 filings ensuring transparency, your investment in corporate tax credits supports students effectively, creating lifelong returns for both your business and the community.

Invest in Futures Today

Corporate tax credits turn your business’s Arizona tax liability into powerful educational investments, and Catholic Education Arizona makes it seamless. From helping families like the Sullivans and Cruz-Patinos to launching careers like Jamie Janos’s, your contribution funds scholarships that last a lifetime. If you have questions about corporate tax credits or want to start, contact us at 602-218-6542 or visit ceaz.org. Empower the next generation—your business can lead the way!