A Catholic education’s impact extends beyond the years children spend in the classroom. It changes lives, shapes core values, and equips students with the necessary tools to successfully embark on the start of their future. “I know I wouldn’t be where I am today without the foundation of my Catholic education,” said Catholic school alumnus Jamie Janos.

As Janos begins his medical school career, he attributes his success to his Catholic education, as well as the success of his entire family. “For generations, this education has empowered my family to achieve our goals while staying grounded in the principles of integrity, service, and compassion,” he said.

As a mother, Wendy Treon shares that she owes every good aspect of her life to her Catholic school upbringing. It influenced her life in such an impactful way that, in her eyes, the trajectory of her life was changed.

“The moral compass I developed in my early years at my Catholic school has been a guiding force in my life. In my high school and college years, I was faced with adversity that could have sent me down a different path,” Treon shared.

Inspired by her experience, Treon returned to her Catholic School to serve as a School Counselor. Today, she is in the 18th year of her career as a counselor and now an Assistant Principal.

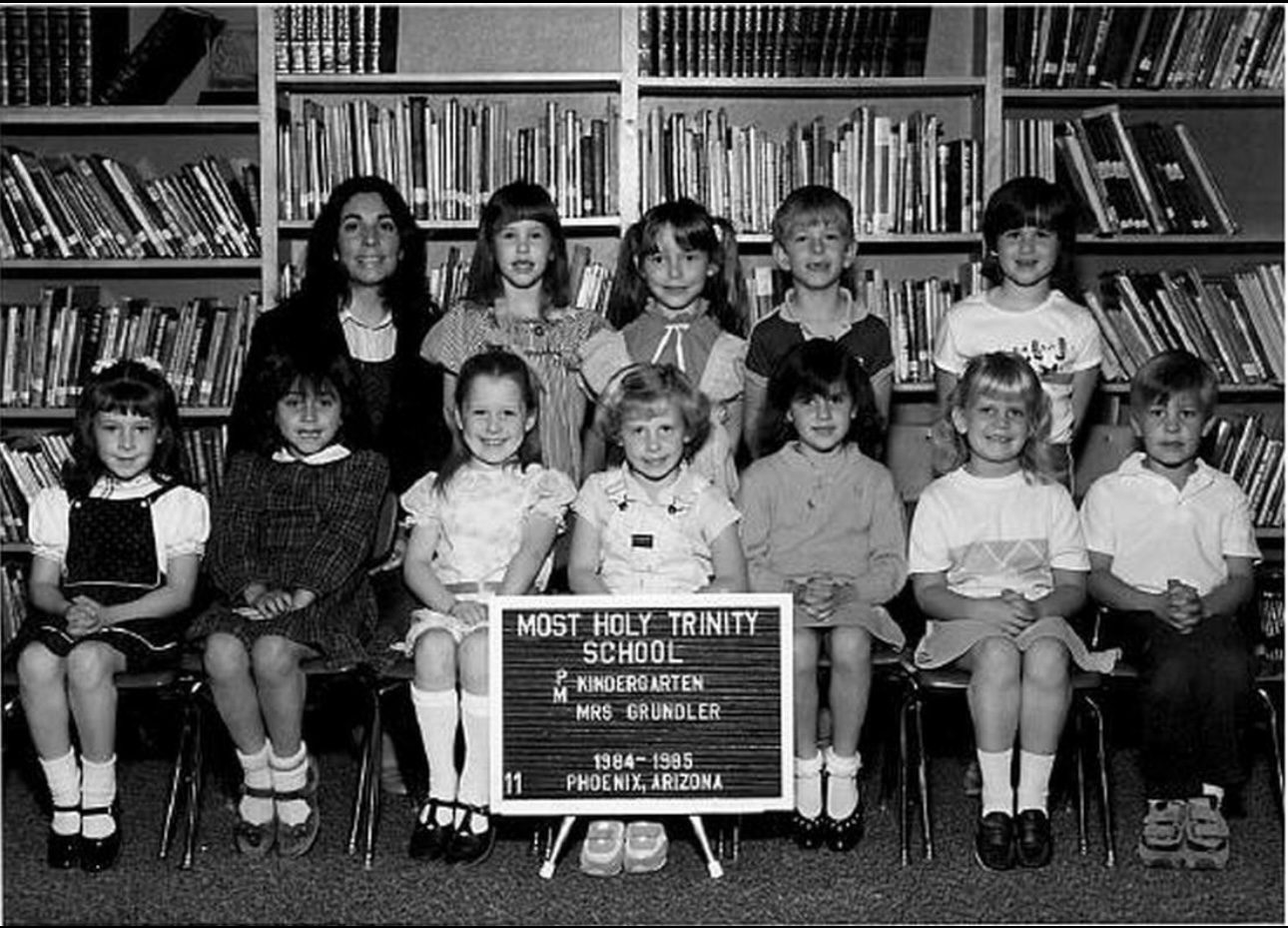

For large families such as the Sullivans, a Catholic education seemed unattainable. Yet, the Sullivans prioritized their beliefs and sent all nine children through Catholic schools with the help of the Catholic Education Arizona scholarships.

“It made God and my religion my world, not just something for Sundays or for my home life. It was a foundation for living that I carried on into adulthood,” said daughter Theresa Sullivan.

You can help families experience the life-changing impact of Catholic education. Since 1998, Catholic Education Arizona has raised $363 million and provided over 157,000 scholarships to underserved students. Make an impact today, call (602) 218-6542.

Catholic Education Arizona is an IRS 501(c)(3) nonprofit charitable organization and has never accepted gifts designated for individuals. Per state law, a school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent.