Catholic Education Arizona has made it simple for corporations and individuals to transform Arizona Tax liability into opportunity. Since 1998, the organization has raised $383 million and awarded 161,000 scholarships for underserved students in Diocese of Phoenix schools—evidence that purpose-driven giving can scale with business.

Why corporate philanthropy is shifting toward tax-credit giving

Across Arizona, companies are aligning philanthropy with balance sheets by using the state’s corporate tax credits to direct 100% of their Arizona state tax liability to Catholic Education Arizona. That means real budgeted tax dollars fund real students while strengthening workforce pipelines and community well-being.

Arizona Tax advantages for individuals and families

Individuals can participate too. For the 2025 tax year, Arizona taxpayers may contribute up to $1,535 (single/head of household) or $3,062 (married filing jointly) as a dollar-for-dollar state tax credit. The “Switcher” credit isn’t optional, it’s a secondary bucket filled after the individual credit is maximized, ensuring more scholarships are available where the need is greatest.

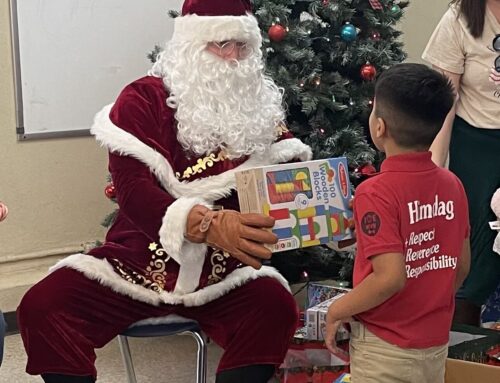

Impact you can quantify—and feel

Since 1998, Catholic Education Arizona’s scholarship funding has opened doors to rigorous academics, faith-centered formation, and strong community engagement. National Catholic Educational Association data consistently highlights positive outcomes tied to Catholic schooling, from graduation rates to civic participation—reinforcing why this is a high-impact place to direct Arizona tax liability.

How Corporations Put Arizona Tax dollars to Work

Eligible C-corps, S-corps, and insurance companies that pay Az Premium Tax can fund tuition scholarships through Catholic Education Arizona. Start here: Contribute

Scholarship access: inclusive, clear, and on a deadline

Families (Catholic and non-Catholic) apply through FAIR using school code 700 and password cea700. Applications for the 2025–26 school year are open now and require 2024 Federal tax return. Need help? Call 602-218-6542 or email info@ceaz.org. Process details: Apply for Scholarships and FAIR: fairapp.com.

Ready to turn taxes into tuition?

Redirect your Arizona state tax liability today to fund scholarships with Catholic Education Arizona: Contribute. Families can get started here: Apply. For questions, call 602-218-6542 or email info@ceaz.org.