The Non-Tax Credit Changing Lives Division funds unmet scholarship needs for underserved students through charitable donations and planned gifts.

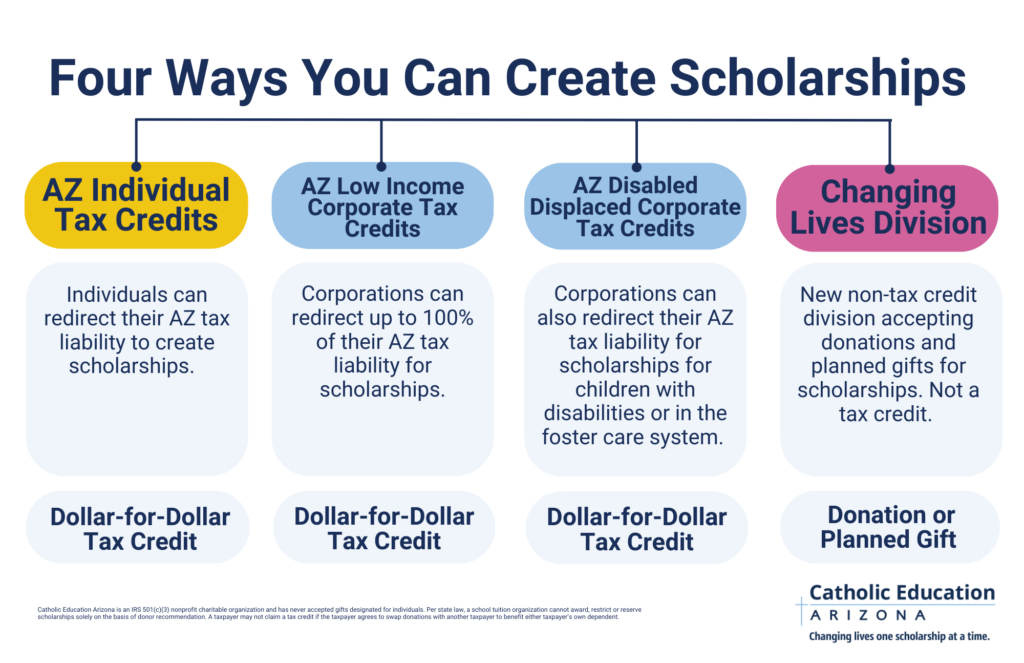

At Catholic Education Arizona, there are now four ways you can change lives through tuition scholarships!

- AZ Individual Tax Credits

- AZ Low-Income Corporate Tax Credit

- AZ Disabled/Displaced Corporate Tax Credit

- Non-Tax Credit Changing Lives Division

Donations to the Changing Lives Division are not tax credits. Any gift to the Changing Lives Division is a charitable donation. However, tax benefits may apply, so we ask that those check with their tax advisor.

Four Ways You Can Create Scholarships

What does the Changing Lives Division help?

In the Diocese of Phoenix, the demonstrated need for tuition assistance exceeds what Arizona tax credits provide. Catholic Education Arizona launched the Non-Tax Credit Changing Lives Division to fund scholarships for students through charitable donations and planned gifts. Charitable donations and planned gifts can fund either the Education Growth Fund, funding scholarships with immediate need, or the Endowment, ensuring scholarship funding for future generations.

What gifts does the Changing Lives Division accept?

The Changing Lives Division accepts cash donations and planned gifts such as bequests, IRA Charitable Rollovers or Qualified Charitable Distribution (QCD), gifts from a donor advised fund, gifts of stock, and more! If you would like to give a cash donation, click here to visit our online giving platform. Once again, this does not act as, nor take the place of, your tax credit contribution. All cash donations to the Changing Lives Division are charitable donations. However, tax benefits of charitable donations may apply, please check with your tax advisor.

Call Us to Learn More

To give a planned gift such as an IRA charitable rollover, bequest, or gift of stock, please visit our Changing Lives Division website at CEAZ.GiftLegacy.com. To speak with Jim Pogge, Director of Development, or Miranda Maciel, Assistant Director of Development, please call (602) 218-6542 or email jpogge@ceaz.org or mmaciel@ceaz.org.